How We Can Help

Ardent Mills Solutions™ is a licensed Commodity Trading Advisor (CTA) designed to help flour buyers navigate volatile commodity markets. We listen to your risk tolerances, learn your risk profile, and help develop flour pricing strategies that make sense for your business.

Understanding Your Risk Profile

First, we work with you to establish your risk profile by analyzing your business goals and key metrics.

A risk profile can be broadly broken down into four components:

|

|

|

|

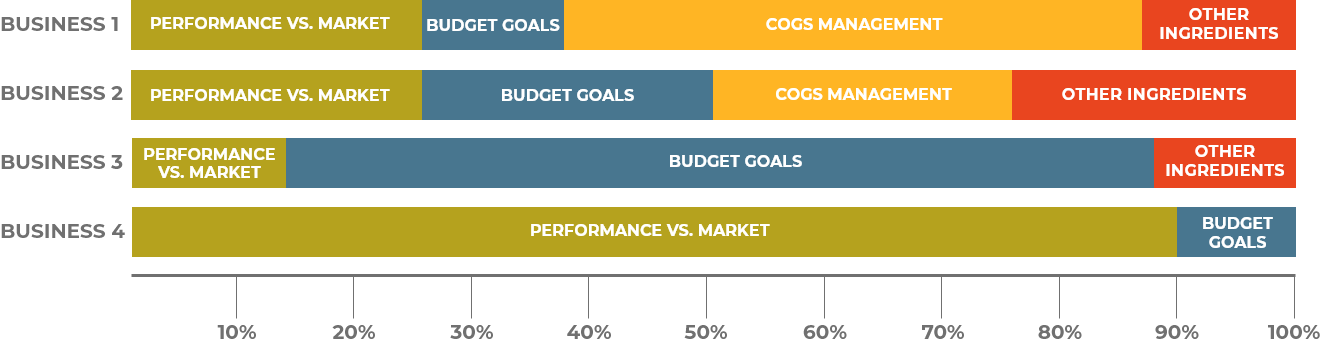

Every Business is Unique, So is Your Risk Profile

Just like an investment portfolio, we understand that every business’ risk profile is different. The visual above illustrate how different businesses have different priorities when it comes to purchasing flour. Some risk profiles may emphasize only one purchasing element, while others focus on multiple elements. We support flour buyers from many business types and sizes, from regional bakeries to international consumer packaged goods (CPG) companies – all with different risk profiles.

Your Ideal Risk Management Solution

Ardent Mills Solutions™ has varied and personalized risk management offerings for you and your business.

|

COMMODITY MARKET AND RISK CONSULTATION Ardent Mills Solutions™ leverages its market experience and enterprise breadth to bring timely, accurate, and actionable information to its customers. Customer Risk Team members listen to our client’s procurement goals and then balance these against commodity market opportunities and risks. |

|

CUSTOMIZED STRUCTURES Ardent Mills Solutions™’ works directly with clients to customize strategies providing more flexibility on timing, quantities and pricing to fit with customer goals and risk profiles. |

|

PERFORMANCE PRICING Leverage Ardent Mills Solutions™ expertise in wheat futures and commodity trading to compete directly against futures market averages. Hire Ardent Mills Solutions™ traders to analyze market information and execute a trading game plan designed to maximize trading results on the most volatile component of flour pricing. |

|

INTEGRATED RISK MANAGEMENT A Risk Management program where we partner with our customers to price flour with a customized program to the specific needs of the client. |

Trading swaps, options, and futures involves a high degree of risk. The risks associated with trading swaps, options, and futures are varied, and the risk of loss can be substantial. Substantial loss can occur because loss might not be limited to the initial investment. Therefore, while determining the best fit we will qualify and work with clients to discuss potential risks associated with service offerings above and implement a tailored risk management solution for our clients.

For more information on such potential risks, please see Disclosure Document